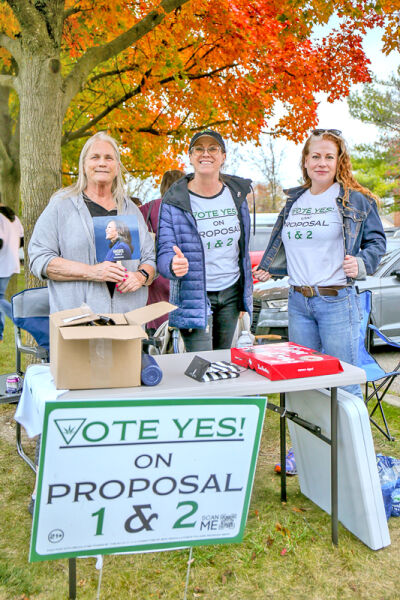

Canvassers in support of Proposals 1 and 2 urged voters to cast a yes vote for cannabis in Lathrup Village. Both proposals failed.

Photo by Patricia O’Blenes

LATHRUP VILLAGE — On Nov. 5, Lathrup Village residents were presented with two cannabis proposals, one to repeal the prohibition of cannabis establishments within the boundaries of the city and one to authorize and allow cannabis businesses and establish fees and regulations for two cannabis retail facilities.

Residents came out in opposition to Prop 1, with 1,758 (59.11%) against and 1,216 (40.89%) in favor. For Prop 2, 1,742 (58.46%) voted against and 1,238 (41.54%) voted yes.

Lathrup Village residents were presented with similar proposals in 2022, where 1,414 (53.87%) voted in favor of keeping cannabis out of the city to 1,211 (46.13%) residents who voted to allow it.

Former Lathrup Village Councilman Ian Ferguson organized in support of the ballot proposals with a group of residents called “MJ 4 LV” to petition to get the proposals on the November ballot, with the petition gaining 450 signatures.

“The citizens of Lathrup Village decided that they did not want cannabis, no matter what kind of education we’ve given them. I was happy that we were able to get it on the ballot. We were really exercising our democratic freedoms and our civil liberties to bring back a proposal that could help our city. I mean, our sole purpose was to try to inject the excise tax into Lathrup annually; every year, we would get that from the state. And at this point, Lathrup has no revenue coming in within the next three to five years. So now there are discussions about Headlee override.”

According to Lathrup Village’s Financial Review Committee’s Recommendation to City Council to Increase and Sustain General Fund Revenue, the city’s general fund has decreased from $1.591 million to $1.242 million to $583,000. In its recommendation, the committee states that Lathrup Village has a revenue problem, not a spending problem.

Only 30% of collected property taxes are used for general city operations. Of the 30% that the city retains, over half of that amount is used to pay for police and fire services, leaving little remaining for other city operations.

“We were trying to get our city to get $118,000 a year, and you don’t see that,” Ferguson added. “That’s fine. I respect your right to vote no, and that’s the sad part. So then now, what do we do next? That’s the question we should ask everyone that voted no. What do you want to do next? That’s it.”

One of the recommendations that the committee is making is to place a Headlee override on the November 2025 ballot, which would ask Lathrup Village voters to increase the Headlee-lowered general operating millage rate from the current 17.3001 mills to the chartered rate of 20 mills, and to increase the lowered refuse millage rate from the existing 2.5948 mills to the chartered rate of 3 mills. The current average taxable value of a home in Lathrup Village is $90,046. Adding the 3.1051 mills to the average taxable value would result in an additional tax of $280 to the average homeowner.

Lathrup Village’s chartered millage rate is 20 mills. However, the market crash of 2008 led to a decrease in aggregate taxable values. In 2010, the rate was 16.08 mills, which produced 20% less revenue for the city’s budget, thus leading to the Headlee override that passed in 2010, allowing the chartered rate to return to 20 mills. However, as the taxable value of the city began to rise over the last 14 years, Headlee has inched the rate down. Since residents are currently taxed at 17.3001 mills, the city’s getting less revenue while city expenses continue to rise.

“We have a revenue problem as a city, and this was a missed opportunity from that perspective,” Lathrup Councilman Bruce Kantor, the committee chair for the Financial Review Committee, said. “Had that proposal won, we would have had two facilities, and then that would have translated to about $120,000 of guaranteed revenue from the state, plus or minus — it varies year by year, but it’s been roughly about $58,000 to $60,000 per facility. So for a small city like Lathrup, with a budget of around $6 million, that’s significant.”

Kantor explained that since marijuana businesses tend to renovate their facilities, that would’ve increased the taxable value and provided more tax benefits for the city.

“A lot of people weren’t talking about is the point systems that are used to determine who gets a license typically will have a component for providing a community benefit by the applicant,” Kantor said. “So, for example, an applicant can get extra points for replacing city playground equipment, adopting a park, paving alleyways, and funding other community needs. … Three years ago, the city passed an ordinance but never initiated the application process, so at that time, applicants were proposing community benefits in the neighborhood of half a million dollars each. So, with two potential facilities, that would have been a million dollars in community benefit. So that would have freed up significant city funds.”

If a Headlee override is approved, the additional revenue would not be received by the city until August 2026, with the summer tax bill. As a short-term solution, the recommendation is for council to enact Public Act 33 of 1951 Special Assessment for Public Safety, which allows cities with a population under 14,500 to levy up to 10 mills for public safety operations and 10 mills for public safety capital. This would allow the City Council to determine its monetary needs for fiscal year 2025 and determine the expected shortfall. After the shortfall is determined, the City Council could set the corresponding millage to the 2025 summer tax bill to make up for the difference. The resulting funds would be allocated for public safety and could cover the increased cost of the new police contract, as well as some other existing public safety costs. This would free up the use of the general fund dollars for public safety to be used for other operational uses. If the City Council accepts the recommendation, then they will work with the city’s administration and city attorney to hold public hearings, resolutions, obtain approvals from the attorney general and governor, etc., required to both enact the Public Act 33 special assessment and place the Headlee override on the November 2025 ballot.

Publication select ▼

Publication select ▼