This colonial home in Madison Heights recently was sold on its first day on the market for $306,000.

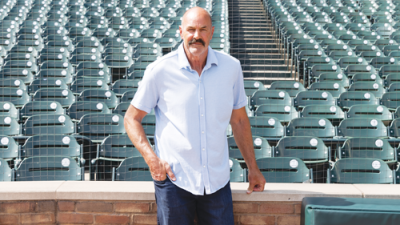

Photo provided by Larry Campbell

METRO DETROIT — The peak of the housing market season is upon Michigan, and it’s proving to be a seller’s market.

Larry Campbell, the owner of Century 21 Campbell Realty in Madison Heights, has been in the business for 49 years and he said the inventory is at an all-time low with no product and no homes to show.

“As a result, there’s still a lot of people that are trying to make purchases, and they’re going into almost auction situations, which isn’t really a comforting feeling for a lot of the buyers,” he said. “Now that the interest rates have started to rise, some people think that will soften the buyer activity, but it has not. Our interest rates today are still at a 50-year low. So the demand is very strong, the inventory is almost nonexistent and as long as that is the situation and there’s the need, the prices are probably going to continue to go up.”

On the topic of interest rates within the housing market, according to Campbell and Kathy Broock, a Realtor with Max Broock Realtors in Birmingham, the rate sits at around 5.5%-5.75%.

“People are complaining that the interest rates are getting higher,” Campbell said. “The interest rates of 5.75 are … the lowest we’ve had in 50 years. At the interest rate today, it’s a wonderful rate. If you go back 50 years, the rates are still higher back then.”

Relative to her career, Broock said, an interest rate of 7%-9% was common for years. So a rate of 5.75% is something she would consider to be low.

“They’re not stratospheric interest rates,” she said. “They’re not out of this world. It’s just uncomfortable, I think, for people who have been looking for a year or two and they could have opted in at 3.5 and now they’re at 5.25. It’s a big change.”

Another issue Campbell discussed is that some homebuyers are unaware that the taxes on a property likely will increase from what the current owners are paying.

Campbell stated that the state equalized value, or one-half of a property’s true cash value, has been capped for many years for people living in their homes, but when a new buyer transfers ownership, the cap comes off and the taxes in some communities can go up 30%-50% or higher.

Campbell said he believes purchasers need to be thoughtful and mindful of their decisions during the buying process to make sure they’re getting a good value and that they’re not getting caught up in the emotional aspect of buying a home.

“People are finding themselves in an auction almost. Seven, eight, nine, 10 people bidding on the same property. That’s not healthy for the economy,” he said.

Broock said this is still a market with high demand, but she believes that the inventory of homes is starting to increase.

“Sellers are realizing this is their time,” she said. “We do have rising interest rates, we do have some volatility, we have some global issues. … I’m sad that it’s taking all of these external issues to occur for sellers to say, ‘I think it’s time to move,’ but COVID made everyone fearful which, respectfully, I get it. And so I think they’re now saying, ‘Well, we’re going to have to deal with what we have. If we want to sell, now’s the time to sell.’”

A big reason why there are so many people looking for a home, Broock added, is because millennials weren’t buying homes at first, and now they’re in the marketplace.

“I just tell people you’ve got to do what you’ve got to do,” she said. “If you’re moving into Michigan or you’re married and you have a kid on the way and you need another bedroom and you want to move, you move.”

Broock said people should really stay in their homes for at least seven years, a length that could be another economic cycle. She also felt that buying a home was more about one’s lifestyle and not about an investment, and that homeowners should focus on enjoying their houses.

“If you’re in a bidding war, you’re in a bidding war,” she said. “Eventually, you’ll get a house, and then you get to enjoy it. I wouldn’t be so concerned about this investment mindset, but you’re buying a home to live in it. Hopefully, you’re staying in there for a while in case there is a downturn in the market … where it’s not affecting you.”

Publication select ▼

Publication select ▼