FARMINGTON/FARMINGTON HILLS — Voters in the Farmington Public Schools district have an operating millage renewal proposal on the Nov. 5 ballot.

“It will help to continue running our operations, which is obviously running our schools, paying our staff, and any of the support services throughout the district,” said Jennifer Kaminski, assistant superintendent for business services at Farmington Public Schools.

The operating millage was created when Proposal A went into effect 30 years ago. Proposal A significantly reduced property taxes and created a foundation allowance for schools. However, this meant that more affluent districts, such as Farmington, would have to function with a greatly reduced budget. Therefore, the state chose to hold those districts harmless and allowed them to ask residential taxpayers to continue to provide the schools with additional funds via the operating millage. The amount they can collect per pupil was determined by the residential taxpayers as well.

“It was the state’s attempt to more equitably fund all districts throughout the state,” said Kaminski.

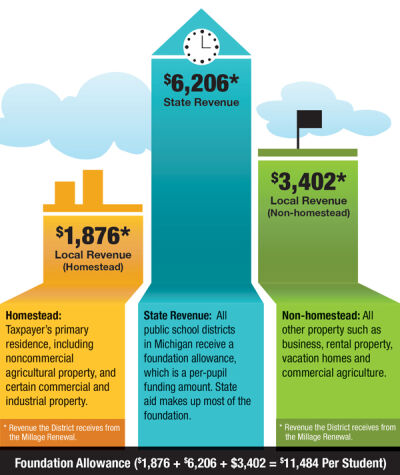

The state provides districts with an allowance of $6,206 dollars per pupil. The district then is able to gain additional operational funds via its operational millage. The voter approved millage currently allows the district to levy 12.5 mills ($1 of tax for every $1,000 of taxable value) on residential homeowners’ property but the district is only levying 5.5 mills, which provides the district with $1,876 per student, and an additional $3,402 is collected from a levy of 18 mills on non-homestead property in the district, such as local businesses. This provides the district with a total of $11,484 per pupil to form its operational budget.

Without the additional funds provided by the millage, the district would lose about $49 million annually.

“The state assumes we are going to collect these property taxes locally. If we don’t, they don’t make it up. We lose that funding,” said Kaminski.

“It would be devastating,” said Diane Bauman, FPS director of school/community relations and pupil accounting.

The proposal is asking voters to continue to provide this income for the schools by renewing the millage for another 10 years. On the November ballot, the district is asking voters to authorize it to take 21 mills on the non-homestead millage, but it will only be able to levy 18 mills at any given time. The request for the additional three mills is to ensure the district always receives the 18 mills over the 10-year period. This insurance is due to the Headlee amendment.

“So, if Headlee comes into play and it says you have to roll back your millage rate, it’s the authorized rate that you roll back, so we would sit at 20.8 (for example). Well, we could still levy 18 mills,” explained Kaminski. “So we would be OK and it would just eat into that authorized amount, and hopefully with sitting it 3 mills higher, we wouldn’t get to the point where we would have to go to the taxpayers and ask for an override.”

Kaminski said homeowners should understand that the district can only collect the $1,876 per pupil, which is based on their enrollment, and that forms the total amount of funds they can collect. She said it is spread over the homestead taxable value and it generates the millage rate each year. Although they are authorized for 12.5 mills, they levied only 5.2 last year.

“The intent is to keep the property tax that we levy from our homeowners fairly stable,” said Kaminski.

“So, they don’t see fluctuations,” added Bauman.

Kaminski said the calculation is reviewed by the Michigan Department of Treasury every year. The funds are collected and sent to the school district by the cities. The current millage expires at the end of 2025. If the millage renewal is approved, it will start in the 2026-2027 school year and will be up for renewal again in 2035.

“We’re asking for the renewal now so that we know that when we get through this year, it’s already approved. We can move forward,” Kaminski said.

“This really does support our daily operations,” she said.

Publication select ▼

Publication select ▼